Our mission is centered on seeking your prosperity and delivering unparalleled value. We stand ready to steer your financial journey toward new heights of success, with unwavering dedication

ABOUT US

IT ALL BEGINS WITH A RELATIONSHIP

There are hundreds of advisors that you can choose from. What makes one better than another? I believe it’s the relationship you develop and the ideology behind planning.

Jacob Dalton is a multifaceted professional with a robust background in finance, insurance, and military service. As the owner of Elite Wealth Management, Jacob has established himself as a experienced figure in the financial services industry, bringing his clients a wealth of knowledge and experience.

Jacob's journey in the financial sector began in 2014. Since then, he has navigated the intricate landscape of finance, steadily advancing from consultative services to becoming a seasoned professional in wealth management. His specialized focus on tax strategies and portfolio strategies showcases a dedication to providing tailored financial solutions.

With licenses including Series 6, Series 63, Series 65, and a life health insurance license, Jacob Dalton possesses a significant understanding of financial regulations and insurance practices. These credentials attest to his commitment to staying current with industry standards and offering diverse services to serve his client's needs.

Jacob's commitment to professional development further underscores his designations as an Accredited Portfolio Management Advisor (APMA®) and a Chartered Retirement Planning Counselor (CRPC®). These qualifications reflect his dedication to upholding the highest standards of professionalism and expertise in the financial advisory realm.

In addition to his thriving career in finance, Jacob serves as a Senior Drill Sergeant in the United States Army Reserve, demonstrating his commitment to duty, leadership, and service to his country. His military background has instilled in him a strong sense of discipline, resilience, and the ability to thrive in challenging environments.

Jacob Dalton's unique combination of financial acumen, diverse licenses, and military leadership positions him as a dynamic professional capable of navigating the complexities of both the financial and military sectors. His commitment to excellence, coupled with his diverse skill set, positions him as a skilled advisor and leader in the intersection of finance and military service.

Jacob M. Dalton APMA® CRPC®

Kevin Medert

Kevin is a financial planner, Retired Army Field Artillery Major, and proud husband to his wife, Chloe, and father to three daughters. During his years of military service, Kevin discovered a deep passion for coaching and mentoring those around him. Today, he carries that same commitment into his work as a Financial Planner – Helping individuals and families build confidence, clarity, and lasting financial security. Kevin believes in serving with integrity, guiding clients toward decisions that make a meaningful and positive impact on their lives.

.jpg)

Brian Reese

Born and raised in Newark, DE, Brian was raised by parents that instilled in him core values like honesty and hard work. He started his first business while still in High School. Through that, he learned the values that come with saving money. He understands the hurdles small business owners face. Brian graduated from West Virginia University with a degree in Finance. He supported himself through college by working in the hospitality industry. after graduating he pursued his passion for the culinary arts by working in James Beard restaurants across the south. He left the hospitality industry in 2017 and spent the next seven years in the wine industry. Wanting a bigger challenger, he entered the financial industry in 2024 by joining with Prudential Advisors. Brian Specializes in holistic financial planning and preparing clients for retirement. He and his wife Rachael enjoy spending time with their two cats, traveling, going to the beach, and watching European football.

Elliott Chase CRPC®

Elliott Chase is a Delaware native and wealth management professional specializing in retirement strategy. He holds the Chartered Retirement Planning Counselor (CRPC®) designation through the College for Financial Planning, along with his Series 7 and Series 66 through FINRA, and life and health insurance licenses. This broad expertise allows him to guide clients through the complexities of retirement with clarity, confidence, and a deep understanding of the financial decisions that matter most during this transition.Elliott graduated from the University of Delaware with a degree in International Business and a minor in Mandarin Chinese. He is committed to empowering individuals and families by making retirement planning approachable and personalized—helping clients feel prepared, informed, and in control as they enter the next stage of life.

OUR

SERVICES

RETIREMENT STRATEGIES

We all have desires to stop working one day. How does your dream compare to your current strategy? Through a comprehensive strategy process I can help pursue your dream into reality with a step by step strategy and projection of the future.

INVESTMENT ADVICE

401(k), 403(b), SEP, SIMPLE IRA, IRA, Roth IRA, Brokerage Accounts, NQDP, Profit Sharing Plans? What should you do with your savings? What strategies make the most sense based on your end goals?

LONG-TERM CARE*

How does your current strategy handle long-term care situations that could deplete your assets? Do you understand the costs, risks and affects of long-term care to your assets? Let me educate you on some new options. * The availability of certain products varies by carrier and state.

INSURANCE STRATEGIES

Life Insurance (Whole Life, Universal Life, Term, Variable), Disability Insurance, Disability Overhead Insurance, Employee Benefits, Annuities. With so many options available how do you decide which is best for you? Where does this fit into your strategy?

BUSINESS CONSULTING

Are you an entrepreneur, small business owner or established business? Are you established as an LLC, LP, DP, S-Corp, C-Corp? How does this affect your business planning solutions? Let’s discuss your strategy.

WEALTH MANAGEMENT

Perhaps you want to include all aspects of financial freedom into your strategy. I offer various strategies and processes for those who want to encompass their complete financial futures in one simple process.

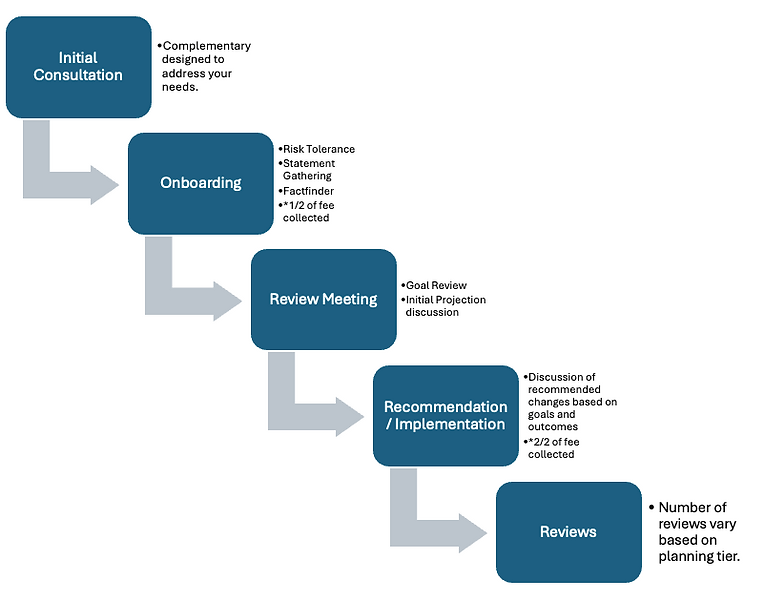

THE PROCESS DEFINED