Start Your Financial Plan

A financial plan is an overview of an individual's, family's, or organization's financial goals, strategies, and actions to achieve those goals. It involves the process of evaluating current financial status, setting specific objectives, and creating a roadmap to achieve those objectives over a defined period. The primary purpose of a financial plan is to help individuals or entities make informed decisions about their finances and manage their resources effectively

Key components of a financial plan typically include:

1. Financial Goals: Clearly defined and measurable objectives, such as buying a home, saving for education, retirement planning, or debt reduction.

2. Budgeting: An analysis of income, expenses, and savings to understand cash flow and allocate resources appropriately.

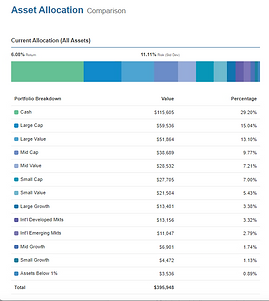

3. Investment Strategy: A plan for how to invest money based on financial goals, risk tolerance, and time horizon. This may include a diversified portfolio of stocks, bonds, real estate, and other investment vehicles.

4. Retirement Planning: Strategies for saving and investing to help ensure a comfortable retirement, including contributions to retirement accounts such as 401(k)s or IRAs.

5. Insurance Coverage: Evaluation of insurance needs, including life insurance, health insurance, and property and casualty insurance, to help mitigate financial risks.

6. Tax Planning: Strategies to help minimize tax liability, including taking advantage of tax-efficient investment options and deductions.

7. Debt Management: A plan for managing and paying off debts efficiently, including credit cards, loans, and mortgages.

8. Estate Planning: Strategies for the orderly transfer of assets to heirs, including wills, trusts, and powers of attorney.

9. Emergency Fund: Setting aside funds to cover unexpected expenses and emergencies, providing financial stability during challenging times.

10. Review and Adjustments: Regularly reviewing and updating the financial plan to adapt to changes in goals, life circumstances, or economic conditions.

Financial planning is an ongoing process that requires periodic reviews and adjustments as circumstances change. Working with a financial advisor can be beneficial to ensure that the plan aligns with individual goals and financial realities.